how to calculate nj taxable wages

Your employer uses the information that you provided on your W-4 form to. Like many other Northeastern states looking at you New York and Illinois taxes in.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

So the tax year 2022 will start from July 01 2021 to June 30 2022.

. After the wage cap is met salary deductions. After a few seconds you will be provided with a full breakdown. However if you do not have withholdings or enough withholdings taken out of a paycheck you may have to make estimated payments.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The New Jersey tax calculator is updated for the 202223 tax year. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

Rates for board and room meals and lodging under the New Jersey Wage and Hour laws or regulations may be found at NJAC. Under the FLSA these. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey.

Read customer reviews find best sellers. Ad Free tax filing for simple and complex returns. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Max refund is guaranteed and 100 accurate. New Jersey State Taxes. Federal income taxes are also withheld from each of your paychecks.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Your average tax rate is 1198 and your marginal tax rate is 22. The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for.

Free means free and IRS e-file is included. The Official Web Site for The State of New Jersey. Guaranteed maximum tax refund.

Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from. You must report all payments whether in cash benefits or. The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported.

The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 1256-8 1256-13 and 1256-14.

The New Jersey income tax calculator is designed to provide a salary example with salary deductions made in New. Calculate your take home pay after federal new jersey taxes deductions and exemptions. Taxable Retirement Income.

Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. How Your New Jersey Paycheck Works. Just enter the wages tax withholdings and other information required.

Ad Browse discover thousands of brands. This marginal tax rate means that. If you estimate that you will owe more than 400 in.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

New Jersey Income Tax Calculator Smartasset

How To Start A Business In New Jersey In 8 Easy Steps 2022

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

New Jersey Extends Retirement Income Exclusion Kulzer Dipadova P A

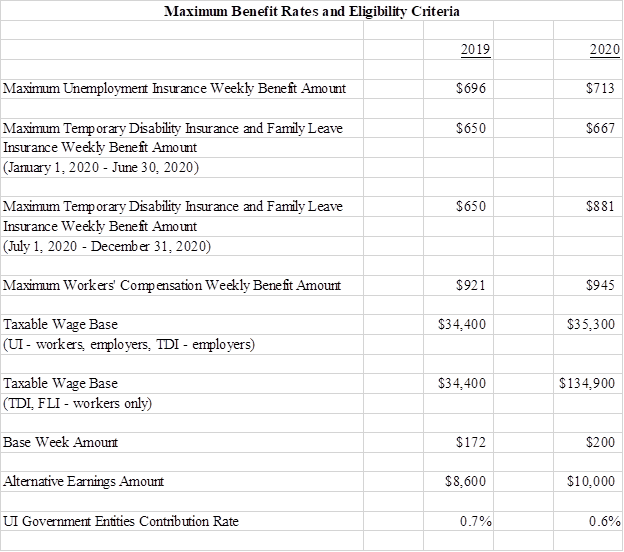

Department Of Labor And Workforce Development Njdol Announces Increases In Maximum Benefit Rates Taxable Wage Base

Just The Facts Nj Taxes Teacher Salaries And Spending Fluff School Finance 101

Individual Income Taxes Urban Institute

Aatrix Nj Wage And Tax Formats

Non Resident Alien Graduate Student Tax Treaty Country

State Corporate Income Tax Rates And Brackets For 2020

2021 New Jersey Payroll Tax Rates Abacus Payroll

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

Prepare E File 2021 New Jersey Income Tax Returns Due In 2022

Employee Compensation Ppt Download

Powerchurch Software Church Management Software For Today S Growing Churches

State Income Taxes Highest Lowest Where They Aren T Collected